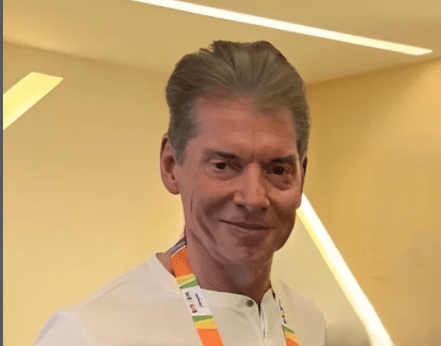

An impressive illustration of how theatrical entertainment and astute economic sense may combine to produce generational wealth is Vince McMahon’s estimated net worth of $3.2 billion. His empire combines spectacle, controversy, reinvention, and financial tenacity, much like a meticulously planned WWE plot. McMahon transformed the WWE from a local attraction to a cultural powerhouse, demonstrating that sports entertainment could make as much money as major league sports and Hollywood movies.

McMahon took over his father’s wrestling organization in the 1980s and aggressively grew it into a national and then international brand. WrestleMania and other pay-per-view events established themselves as cultural mainstays, giving rise to well-known figures like John Cena, The Rock, and Hulk Hogan. These celebrities transformed choreographed fights into lucrative ventures, much like performers supported by Marvel or Warner Bros. McMahon’s ability to develop crossover stars strengthened his own wealth and guaranteed WWE’s survival.

Vince McMahon – Personal and Professional Profile

| Category | Details |

|---|---|

| Full Name | Vincent Kennedy McMahon |

| Date of Birth | August 24, 1945 (Age 80 in 2025) |

| Birthplace | Pinehurst, North Carolina, USA |

| Occupation | Wrestling Promoter, Commentator, Businessman, Film Producer, Occasional Wrestler |

| Net Worth (2025) | $3.2 billion |

| Major Role | Former CEO & Chairman, World Wrestling Entertainment (WWE) |

| Current Holdings | 16% stake in TKO Group Holdings (approx. 23.4 million shares) |

| Annual Salary | $1.2 million (as of 2023) |

| Dividends | Over $12 million in after-tax dividends from WWE shares (2017) |

| Other Ventures | WWE, TKO Group, Alpha Entertainment, XFL, Southern Sports Holdings |

| Real Estate | Greenwich mansion ($40 million), NYC penthouse, luxury yacht |

| Family | Married to Linda McMahon since 1966, two children, six grandchildren |

| Reference Link |

McMahon held 38% of WWE’s total shares at his height, giving him almost 80% of the voting power through class B stock. He was in charge of both financial strategy and creative direction because of such control. McMahon successfully timed his stock sales in 2017 and 2019, collecting hundreds of millions of dollars before steep drops. His grandiose Alpha Entertainment enterprise, which included the expensive relaunch of the XFL football league, was financed by such sales. Even though the XFL failed twice, the project demonstrated McMahon’s extraordinarily bold risk appetite, which is very comparable to Elon Musk’s readiness to take a chance on projects like SpaceX before success was certain.

McMahon’s status as one of the most important power brokers in the entertainment world was solidified in 2023 when WWE and UFC merged under Endeavor’s TKO Group. Shortly after the IPO, his 16% stake—worth over $2.3 billion—made him a key player in the new business. His financial stability allowed him to weather reputational storms with remarkable effectiveness, even when he resigned from the board in 2024 owing to legal issues. For comparison, Rupert Murdoch faced comparable upheaval but managed to hold onto his empire by protecting his finances. The same pattern can be seen in McMahon’s trajectory: public scrutiny counterbalanced by an unusually strong financial base.

Dividends have consistently been a particularly advantageous component of McMahon’s fortune. He and Linda received $12 million in after-tax dividends in 2017, which provided stability despite changes in stock prices. Considering his billions in assets, his official WWE compensation of $1.2 million in 2023 seemed insignificant, but it represented his ongoing involvement in the industry. His varied investments, which included businesses like Microsoft and Comcast, guaranteed supplementary revenue streams. His wealth was solid and enormous because to this extremely effective portfolio management strategy.

McMahon’s opulent success is reflected in his lifestyle. His $40 million Greenwich property is still a focal point of his legacy, while his $12 million Manhattan penthouse and opulent yacht demonstrate his penchant for extravagance. These resources bring to mind media tycoons such as George Lucas or Jerry Bruckheimer, whose lavish lifestyles are a direct result of their storytelling revenues. However, in contrast to Hollywood producers, McMahon created an empire where drama itself was a product, blurring the boundaries between truth and fiction.

The most notable development in his empire in recent years has been the establishment of TKO Group. The combination of WWE’s staged drama and UFC’s unscripted fighting gave investors a hybrid company that had both theatrical appeal and athletic authenticity. TKO showed how entertainment might expand across continents by utilizing worldwide streaming agreements, analytical analytics, and foreign tours. McMahon’s fingerprints on this merger demonstrate his remarkable adaptability, which is remarkably similar to Taylor Swift’s rebranding of her career in order to safeguard and grow her wealth.

When it comes to societal influence, McMahon’s narrative is particularly evident. By establishing a platform for wrestlers to become cultural icons and launching celebrities like The Rock and John Cena into Hollywood, he changed the landscape of what was possible for athletics. WWE’s global presence also had an impact on the economy through tourism and products related to major events like WrestleMania. In terms of cultural influence, McMahon’s fortune was both material and metaphorical, signifying the ability of entertainment to bring together followers from all walks of life.

Critics contend that controversies damaged his reputation, particularly the claims that caused him to resign in 2024 and retire in 2022. Nevertheless, McMahon’s wealth significantly increased through strategic transactions and stock holdings notwithstanding the issue. This contradiction is similar to how strong media personalities frequently outlive public outcry because of incredibly resilient financial ecosystems. His continued financial domination demonstrates that, when supported by ownership and equity, spectacle—even when scandalous—can nonetheless generate enormous returns.