Ray Dalio has maintained his influence and significantly raised his net fortune by discreetly leaving Bridgewater Associates while continuing to be an active thinker. His projected wealth of $15.4 billion as of 2025 is a striking example of how sound financial judgment, long-term planning, and a diversified outlook can still surpass the majority of tech-led riches. Dalio continues to influence financial discourse through his public appearances, macroeconomic projections, and remarkably pertinent commentary on debt cycles, inflation, and world order, even after selling his last share in Bridgewater in the middle of 2023.

Dalio has deliberately positioned himself as more than a hedge fund manager during the last few decades. Since starting Bridgewater out of his New York apartment in 1975, Dalio has gone from being an outcast on Wall Street to a key player advising heads of state and institutional titans. With over $160 billion under management, Bridgewater was already the biggest hedge fund in the world by 2013. Although Dalio has always tended toward systems thinking rather than stock-picking charisma, that milestone solidified his reputation among industry titans like Warren Buffett and George Soros.

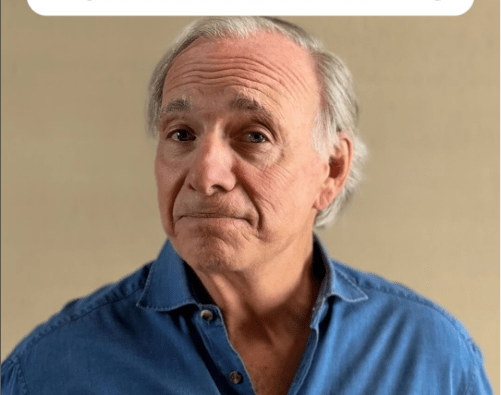

Ray Dalio — Profile and Career Summary

| Name | Ray Dalio |

|---|---|

| Full Name | Raymond Thomas Dalio |

| Date of Birth | August 8, 1949 |

| Age (2025) | 76 |

| Birthplace | New York City, U.S. |

| Education | BS – Long Island University, Post; MBA – Harvard University |

| Occupation | Hedge Fund Manager, Author, Investor |

| Known For | Founder of Bridgewater Associates |

| Spouse | Barbara Dalio |

| Children | 4 sons, including Paul Dalio |

| Estimated Net Worth | $15.4 Billion (2025) |

| Forbes Rank | #124 Richest Person (Dec 2024) |

| Notable Book | Principles: Life & Work (2017) |

| Official Profile | Forbes Ray Dalio Profile |

Dalio’s management philosophy was renownedly enshrined in his book Principles: Life & Work. He was especially inventive in his application of macroeconomic models and radical transparency within his company. The book has developed into an exceptionally useful guide for decision-making, leadership, and corporate governance. Dalio’s transformation from financier to thought leader has been aided by its appeal to MBA programs, startup founders, and even politicians. In actuality, he has remarkably influenced discussions outside of the financial domain with his published frameworks and public appearances.

In a recent keynote address at Abu Dhabi Finance Week, Dalio likened the current state of the U.S. economy to a patient who is about to have a heart attack. He promoted portfolio diversification and, in particular, advised investors to hold 10–15% gold. His historical-based counsel, which reminded listeners that gold often rises when fiat institutions falter under excessive debt, was not only powerful metaphorically. Dalio used these historical connections to send a warning about the vulnerability of contemporary financial ecosystems that was remarkably resilient.

The fact that Dalio continues to make good money after officially leaving his hedge fund is what makes his career arc so intriguing. Speaking engagements, royalties, investment returns, and strategic holdings are currently the main sources of his income. His brand, which is based on predictions supported by statistics and remarkably insightful commentary, has become quite effective at making money off of intellectual property. Dalio has discovered a remarkably scalable second act, whether it is talking about the “Changing World Order” or responding to geopolitical queries on social media.

Dalio frequently stresses humility and learning from mistakes, even though he is a multibillionaire. A new generation of investors navigating unstable markets finds great resonance in this philosophy. Millions of people have watched his animated movie, How the Economic Machine Works, which has been used in high school classes and at economic summits to discuss government failures and debt cycles. As someone who used borrowed money to trade commodity futures, Dalio’s transition into an institutional sage has been exceptionally seamless and adaptable.

Dalio’s charitable endeavors have grown after he left Bridgewater’s day-to-day management. He has invested hundreds of millions of dollars in healthcare, education, and climate change initiatives through the Dalio Foundation. By doing this, he has allied himself with people like Michael Bloomberg and Bill Gates, even if his donations are frequently less well-known. Nonetheless, the scope of his charitable endeavors indicates a sustained dedication to tackling the systemic issues he often addresses in his economic projections.

Dalio’s ability to provide context—to connect macroeconomic statistics with historical cycles and behavioral psychology—sets him apart from many of his wealthy contemporaries. His unique mix has made him a popular guest on websites like TED and CNBC. His remarks are regularly measured and frequently distinguished by their extraordinary breadth and delivery. And for someone whose career started before the advent of personal computers or Wall Street’s deregulation, Dalio is still remarkably active at the age of 76.

Similar to Warren Buffett’s yearly letters, Dalio’s opinions have a big impact on a variety of businesses. Economists, policy experts, and investors are still analyzing his opinions to find hints about interest rates, sovereign risk, and currency fluctuations. He has frequently been early but ultimately correct. For example, he warned about income disparity years before the Occupy movement or legislative changes toward wealth taxation. His reputation as a visionary has been greatly enhanced by their innovative discoveries.